kaleco.ru

Gainers & Losers

Nktr News

Nektar Therapeutics Presents First Preclinical Data on NKTR, a TNFR2 Agonist Antibody Being Developed for the Treatment of Inflammatory. View the latest Nektar Therapeutics (NKTR) stock price, news, historical charts, analyst ratings and financial information from WSJ. Get the latest Nektar Therapeutics (NKTR) stock news and headlines to help you in your trading and investing decisions. Stocks Rankings for NKTR. U.S. News compares companies to their industry peers based on a variety of company fundamentals, performance metrics and investor. Stock analysis for Nektar Therapeutics (NKTR:NASDAQ CM) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Nektar files to sell 25M shares of common stock for holders. 3M ago. NKTR · See More NKTR News >. Company Description. Nektar Therapeutics. Nektar Therapeutics. Get Nektar Therapeutics (NKTR:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Get Nektar Therapeutics (NKTR.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Nektar to reduce workforce by 70%. Shares of Nektar Therapeutics were down % in premarket trading on Tuesday, the day after the company said it will lay. Nektar Therapeutics Presents First Preclinical Data on NKTR, a TNFR2 Agonist Antibody Being Developed for the Treatment of Inflammatory. View the latest Nektar Therapeutics (NKTR) stock price, news, historical charts, analyst ratings and financial information from WSJ. Get the latest Nektar Therapeutics (NKTR) stock news and headlines to help you in your trading and investing decisions. Stocks Rankings for NKTR. U.S. News compares companies to their industry peers based on a variety of company fundamentals, performance metrics and investor. Stock analysis for Nektar Therapeutics (NKTR:NASDAQ CM) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Nektar files to sell 25M shares of common stock for holders. 3M ago. NKTR · See More NKTR News >. Company Description. Nektar Therapeutics. Nektar Therapeutics. Get Nektar Therapeutics (NKTR:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Get Nektar Therapeutics (NKTR.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Nektar to reduce workforce by 70%. Shares of Nektar Therapeutics were down % in premarket trading on Tuesday, the day after the company said it will lay.

Nektar Therapeutics Stock Is Risky But Offers Big Reward Nektar Therapeutics pulled back in recent weeks, and that is a good thing. Valuations are stretched. Nektar Therapeutics (NKTR) News Today Nektar Therapeutics (NASDAQ:NKTR - Get Free Report) CEO Howard W. Robin sold 14, shares of the company's stock in a. Nektar Therapeutics (NKTR) - Develops of novel therapeutics to treat cardio-metabolic, liver, oncologic, and ophthalmic diseases. Nektar Therapeutics (NKTR). (%). Chart. Today 6M 1Y 5Y. Upcoming Events. - Earnings (11/6/24 *Est.) Latest Headlines. Latest News · Aug 08Nektar Therapeutics Reports Second Quarter Financial Results · Aug 01Nektar to Announce Financial Results for the Second Quarter on. NKTR - Nektar Therapeutics (NasdaqCM) - Share Price and News. Nektar Therapeutics. NASDAQ. (%). Last Update Aug 23, , PM EDT REAL. Breaking News - The Fly. The Fly team scours all sources of company news, from mainstream to cutting edge,then filters out the noise to deliver shortform. Latest Nektar Therapeutics News: View NKTR news and discuss market sentiment with the investor community on kaleco.ru Nektar Therapeutics Stock (NASDAQ: NKTR) stock price, news, charts, stock research, profile. Why Nektar Therapeutics Stock Is Sinking Today The biotech is throwing in the towel on an experimental painkiller after receiving a thumbs-down from two FDA. Nektar (NKTR) Up % Since Last Earnings Report: Can It Continue? Apr 3, • Zacks. News for Nektar Therapeutics Stock (NKTR). Nektar to Announce Financial Results for the Second Quarter on Thursday, August 8. Complete Nektar Therapeutics stock information by Barron's. View real-time NKTR stock price and news, along with industry-best analysis. View the real-time NKTR price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. Nektar Therapeutics Stock (NASDAQ: NKTR) stock price, news, charts, stock research, profile. The latest Nektar Therapeutics stock prices, stock quotes, news, and NKTR history to help you invest and trade smarter. View Nektar Therapeutics NKTR stock quote prices, financial information, real-time forecasts, and company news from CNN. Find the latest NKTR stock news. View the Nektar Therapeutics news and quotes for today, invesment news based on TipRanks market-leading research tools. View the latest Nektar Therapeutics (NKTR) stock price, news, historical charts, analyst ratings and financial information from WSJ. Latest News · Watchlist · Market Data Center · U.S. · Cryptocurrency · Europe · Rates NKTR; Profile. Stock Screener · Earnings Calendar · Sectors · Nasdaq.

Apply For Turbotax Loan

If you are approved, your Refund Advance funds are typically available within 4 minutes of the IRS accepting your e-filed tax return. TurboTax offers tax refund loans through lender First Century Bank. Loan Amounts, Up to $4, Time to Fund, TurboTax says most people get their funds. Here's how to apply for the TurboTax Refund Advance: · Before you finish filing, choose Refund Advance† for your refund option. · Simply open a checking account. Click the Filing Your Taxes simulation to begin. Once you have completed the first simulation, select one or more of the remaining simulations to explore how. You can apply for up to $4, based on the size of your federal refund with a Refund Advance loan. Refund Advance has $0 loan fees, 0% APR, and no impact. Fees for other optional products or product features may apply. Tax returns may be filed electronically without applying for this loan. Loans offered in. Roughly 37% of taxpayers qualify. Must file between November 29, and March 31, to be eligible for the offer. Includes state(s) and one (1) federal tax. Any charges or fees for electronically filing the tax return. The total dollar amount of all charges and fees. The estimated annual percentage rate of the loan. In January, you can provide your W-2 and other tax documents to complete filing your taxes and apply for a Refund Advance loan until February 11, If I. If you are approved, your Refund Advance funds are typically available within 4 minutes of the IRS accepting your e-filed tax return. TurboTax offers tax refund loans through lender First Century Bank. Loan Amounts, Up to $4, Time to Fund, TurboTax says most people get their funds. Here's how to apply for the TurboTax Refund Advance: · Before you finish filing, choose Refund Advance† for your refund option. · Simply open a checking account. Click the Filing Your Taxes simulation to begin. Once you have completed the first simulation, select one or more of the remaining simulations to explore how. You can apply for up to $4, based on the size of your federal refund with a Refund Advance loan. Refund Advance has $0 loan fees, 0% APR, and no impact. Fees for other optional products or product features may apply. Tax returns may be filed electronically without applying for this loan. Loans offered in. Roughly 37% of taxpayers qualify. Must file between November 29, and March 31, to be eligible for the offer. Includes state(s) and one (1) federal tax. Any charges or fees for electronically filing the tax return. The total dollar amount of all charges and fees. The estimated annual percentage rate of the loan. In January, you can provide your W-2 and other tax documents to complete filing your taxes and apply for a Refund Advance loan until February 11, If I.

Intuit TurboTax profile picture · Intuit TurboTax updated their cover photo. Jul 18. . It's not too late to file with TurboTax. Let's get your taxes done. How to Apply for TurboTax Refund Advance · When filing your tax return with TurboTax, select Refund Advance as your refund option. · Open a Credit Karma Money. You may not claim the AOTC unless you, your spouse (if you are filing a joint return) and the qualifying student have a valid taxpayer identification number . Get up to $ instantly in as few as 30 seconds of IRS E-file acceptance. Absolutely $0 loan fees and 0% APR. Terms apply. The Refund Advance loan has a 0% APR and zero loan fees. To apply for the Refund Advance, you must e-file your federal tax return with TurboTax. Availability. Here's how to apply for the TurboTax Refund Advance: · Before you finish filing, choose Refund Advance† for your refund option. · Simply open a checking account. Start filing your taxes for the tax filing season. AmeriCU members Apply For a Loan. Login. AmeriCU Logo. Bank. Save · Share Savings · Money Markets. by TurboTax• 76• Updated 2 months ago Refund Advance isn't available if you've already filed your return with the IRS. You'll receive your refund by the. You must file an amended return and reduce any IRA deduction and any retirement savings contributions credit you claimed. Can I direct part of my refund to pay. The tax preparer will give you your refund within a day or two of filing your taxes. You don't have to wait for the IRS to send you the refund or deposit it in. Intuit TurboTax offers tax refund advances with no interest and a fully online application process. You'll receive a portion of your tax refund as an advance. Refund Advance is a no-interest loan that is repaid with your tax refund. Apply between Jan. 2, and Feb. 29, To apply for a Refund Advance, you must file your taxes using H&R Block and pass the lender's eligibility criteria (including a sufficient expected tax refund. You may get up to $7, · Get money before your refund is ready · Getting an advance is easy · Apply today. You may get up to $7, · Get money before your refund is ready · Getting an advance is easy · Apply today. Quick question - so i have never did the advance loan before, and i always typically file before the acceptance date ; if i file now and go. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software. If you haven't submitted yet, login credit karma to do your taxes. It'll take you to turbo tax and the option will be there . I didn't have the. file loan fee schedules. Payments can be made using a credit card. Sign in. Find. Find Registrants · Enforcement Actions · FAQs · Legal & Compliance References. General Electric Credit Union has partnered with TurboTax. With TurboTax, get Apply for a loan · Apply for a mortgage. Change the way you pay. Make.

Quick Cash On Cash App

What's Free Money: Cash App for earning rewards online? You can procure rewards on the web and afterward money out with your preferred installment. Advance the money you need with no credit check or late fees. It takes only minutes to download the Dave app, securely link your bank, and send the money to a. Utilizing Cash App Referral Program. One of the easiest and most effective ways to earn free money on Cash App is by taking advantage of its referral program. Cashing out money from Cash App to a linked account is a common transaction. How fast that money can be accessed after transferring it from the app varies. Cash App offers standard transfers to your bank account and Instant transfers to your linked debit card. Standard transfers are free and arrive within A copy of the Cash App Terms of Service, and related policies, can be found here. Having a debit card linked to your Cash App may let you convert pending Standard transfers to Instant transfers: If the button is unavailable, then the. Get the money you need today, start building credit, and set yourself up for a bright financial future. GET STARTED WITH BRIGIT: 1. Download Brigit 2. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. What's Free Money: Cash App for earning rewards online? You can procure rewards on the web and afterward money out with your preferred installment. Advance the money you need with no credit check or late fees. It takes only minutes to download the Dave app, securely link your bank, and send the money to a. Utilizing Cash App Referral Program. One of the easiest and most effective ways to earn free money on Cash App is by taking advantage of its referral program. Cashing out money from Cash App to a linked account is a common transaction. How fast that money can be accessed after transferring it from the app varies. Cash App offers standard transfers to your bank account and Instant transfers to your linked debit card. Standard transfers are free and arrive within A copy of the Cash App Terms of Service, and related policies, can be found here. Having a debit card linked to your Cash App may let you convert pending Standard transfers to Instant transfers: If the button is unavailable, then the. Get the money you need today, start building credit, and set yourself up for a bright financial future. GET STARTED WITH BRIGIT: 1. Download Brigit 2. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY.

Open the Cash App; Enter the amount; Tap Pay; Enter an email address, phone number, or $cashtag; Enter what the payment is for; Tap Pay. Understand the inner workings of cash advance apps, and see which one may fit your needs. With the QuickBenjy app, you can borrow from $$, and be sent directly to your bank account within seconds! Brigit is a cash advance app that falls into the category of short-term financial management solutions. It offers an alternative option for. Step 1: Open the Cash App · Step 2: Tap on the "Money" Tab · Step 3: Scroll Down and Select "Borrow" · Step 4: Unlock the Borrow Feature · Step 5. Pay anyone instantly. It's free to send and receive money, stocks, or bitcoin within Cash App. Cash App is a financial services platform, not a bank. What happens if I don't verify my identity with Cash App? The card can be used anywhere Visa is accepted, and it's the only way to get Boosts - instant discounts that work at places where you want to spend. Order the. Cash App (formerly Square Cash) is a mobile payment service available in the United States and the United Kingdom that allows users to transfer money to one. Your money isn't FDIC insured, like it would be in your bank account. So, if you get scammed on Cash App, you have no protection or recourse to reclaim your. How to pay Square Sellers or select third party merchants using the Cash App QR scanner · Tap the Payments '$' tab on your Cash App to get to the home screen. When you receive a Cash App payment, it will be available instantly in your balance. You can then choose to send the money to friends or family, or Cash Out to. With Gerald, you can get an easy cash advance online, through our app. You can rest assured that when you get your cash advance from Gerald, you're getting it. Apps like Albert, Chime, Dave, MoneyLion, Cleo, Brigit, and Klover offer convenient and hassle-free cash advance services. Understand the inner workings of cash advance apps, and see which one may fit your needs. Withdrawals to your bank account from your Cash App appear on your statement with the prefix Cash App*. Related. Deposit wasn't Instant. Cash App has quite a few different features. The app allows for lightning speed transactions - sending and receiving money is quick, easy and convenient. If you're looking for a fast and simple way to send and receive money, Cash App has you covered. Cash App gives you the ability to make instant transactions. 1. Refer friends to Cash App and get paid with the Cash App referral program · 2. Sign up for Cash App and get a bonus · 3. Shop and earn with Cash App Boosts · 4. With Instant Cash, you can get $50–$ in minutes. No late fees. No tipping. No credit check. Direct deposit to your bank account.

Is The Iphone 6 5g Compatible

Anything that can support 4G/LTE will still work with most US carriers. So the 5 and newer. I've put my sim in my old 5s as recently as 3 months. Here are the known compatible devices with the popular iOS and Android device brands. - Oppo Reno 6 Pro 5G. Important. The following models are not eSIM-. See the countries and regions that have certified 5G and LTE networks on iPhone including the U.S., Canada, Japan, Germany, China mainland, and more. For details on 5G support, contact your carrier and see kaleco.ru iPhone 6s Plus, iPhone 6s, iPhone 6 Plus, iPhone 6, iPhone SE (1st. No, the iPhone 6s does not support 5G connectivity. The iPhone 6s was released in September , and it only supports up to 4G LTE connectivity. The iPhone 6 supports 3G, 4G LTE, Bluetooth and it's the first Apple handset to also support NFC. Early verdict. Based on our first impressions the iPhone 6. Which iPhone models are 5G compatible? Use this guide to see which iPhone iPhone 6 / iPhone 6 Plus, No, 4G LTE, 4G, 3G, 2G. Which iPhone models are 5G. Service Plans are compatible with both 4G LTE and 5G Network. A month equals 30 days. Prices do not include fees or taxes. †4G LTE capable device required. Go to Settings > Cellular > Cellular Data Options or Settings > Mobile Data > Mobile Data Options. If you see this screen, your device is 5G capable. Screenshot. Anything that can support 4G/LTE will still work with most US carriers. So the 5 and newer. I've put my sim in my old 5s as recently as 3 months. Here are the known compatible devices with the popular iOS and Android device brands. - Oppo Reno 6 Pro 5G. Important. The following models are not eSIM-. See the countries and regions that have certified 5G and LTE networks on iPhone including the U.S., Canada, Japan, Germany, China mainland, and more. For details on 5G support, contact your carrier and see kaleco.ru iPhone 6s Plus, iPhone 6s, iPhone 6 Plus, iPhone 6, iPhone SE (1st. No, the iPhone 6s does not support 5G connectivity. The iPhone 6s was released in September , and it only supports up to 4G LTE connectivity. The iPhone 6 supports 3G, 4G LTE, Bluetooth and it's the first Apple handset to also support NFC. Early verdict. Based on our first impressions the iPhone 6. Which iPhone models are 5G compatible? Use this guide to see which iPhone iPhone 6 / iPhone 6 Plus, No, 4G LTE, 4G, 3G, 2G. Which iPhone models are 5G. Service Plans are compatible with both 4G LTE and 5G Network. A month equals 30 days. Prices do not include fees or taxes. †4G LTE capable device required. Go to Settings > Cellular > Cellular Data Options or Settings > Mobile Data > Mobile Data Options. If you see this screen, your device is 5G capable. Screenshot.

Compatibility of Apple iPhone 6 with operators of USA ; T-Mobile · n2 ( PCS); n41 (); n66 (); n71 (); n mmWave (28GHz); n mmWave (26GHz). Compatible BrandApple iPhones; UseFingerprint Sensor; Compatible BrandApple iPhone; DesignBAR. Item description Report Item. Description. 1: For iPhone 5G While AT&T lists the iPhone 6 as a compatible model in their PDF file about remaining devices, the GSMA Red Pocket Mobile network requires an iPhone 6S or newer. The good news is that at this point the answer to both of those questions is probably yes, as all recent iPhones work with 5G, including the iPhone 15, iPhone. Yes, it support 5G, but the 5G also needs to be supported by carrier. In my country (Europe) the one carrier didn't support 5G for the Apple devices. See the countries and regions that have certified 5G and LTE networks on iPhone including the U.S., Canada, Japan, Germany, China mainland, and more. iPhone and 5G. The latest iPhone 16 models, all iPhone 15 models, all iPhone 14 models, all iPhone 13 models, all iPhone 12 models and the latest iPhone. Go to Settings > Mobile Data > Mobile Data Options or Settings > Cellular > Cellular Data Options. If you see this screen, your device is 5G capable. Screenshot. Apple iPhone 6s A TD-LTE 64GB (Apple iPhone 8,2) is compatible with 5 out of 12 bands on T-Mobile (United States). See the tables below for details. iPhone 11 series; iPhone 12 series; iPhone 13 series; iPhone 14 series; iPhone Oppo Reno 6 Pro 5G; Oppo Reno 7A; Oppo Reno 9A; Oppo Reno 10 Pro 5G. Other. Any iPhone from the 6 and up has 4G/LTE and VoLTE support on it. The iPhone 6 came out in Apple no longer provides software updates for devices older than. If it's a 5G Plan being used on a 4G Speed, it will just run at 4G Speeds. (Even Bell and Telus who are activating people like seniors using an iPhone 6 on. iPhone and iPad: Run iOS 13 and up. Google Fi only supports eSIM on iPhone 14 and The Google Store or Google Fi sell Designed for Fi phones and give you the. All four of its new iPhone 12 models come with next generation 5G cellular connectivity. 5G NR (sub 6 GHz, FR1), LTE and legacy RATs. In comparison. Learn which devices are eSIM compatible. This list includes iPhones, iPads, Android phones and Windows-based laptops. Contact your network provider to confirm that they support 5G and that you're on a mobile plan that supports 5G. · Make sure you're in an area with 5G coverage. The first 5G-capable iPhones now come with a Qualcomm modem. Which iPhones support 5G? To date, here is the list of compatible 5G iPhones. 5G connectivity. As of , the most recent iPhone models are the iPhone 16 A (some models)/Gigabit-class LTE/5G (sub-6 GHz and mmWave (some models)). Apple phones equipped with an eSIM: iPhone XS, XR, 11 models. iPads equipped with an eSIM: new models of iPad Pro, Air, Nano. Here's the complete list >>. If your device is unlocked to all networks and supports 5G, you should be able to connect to our 5G network. · iPhone 15 Pro Max · iPhone 15 Pro · iPhone 15 Plus.

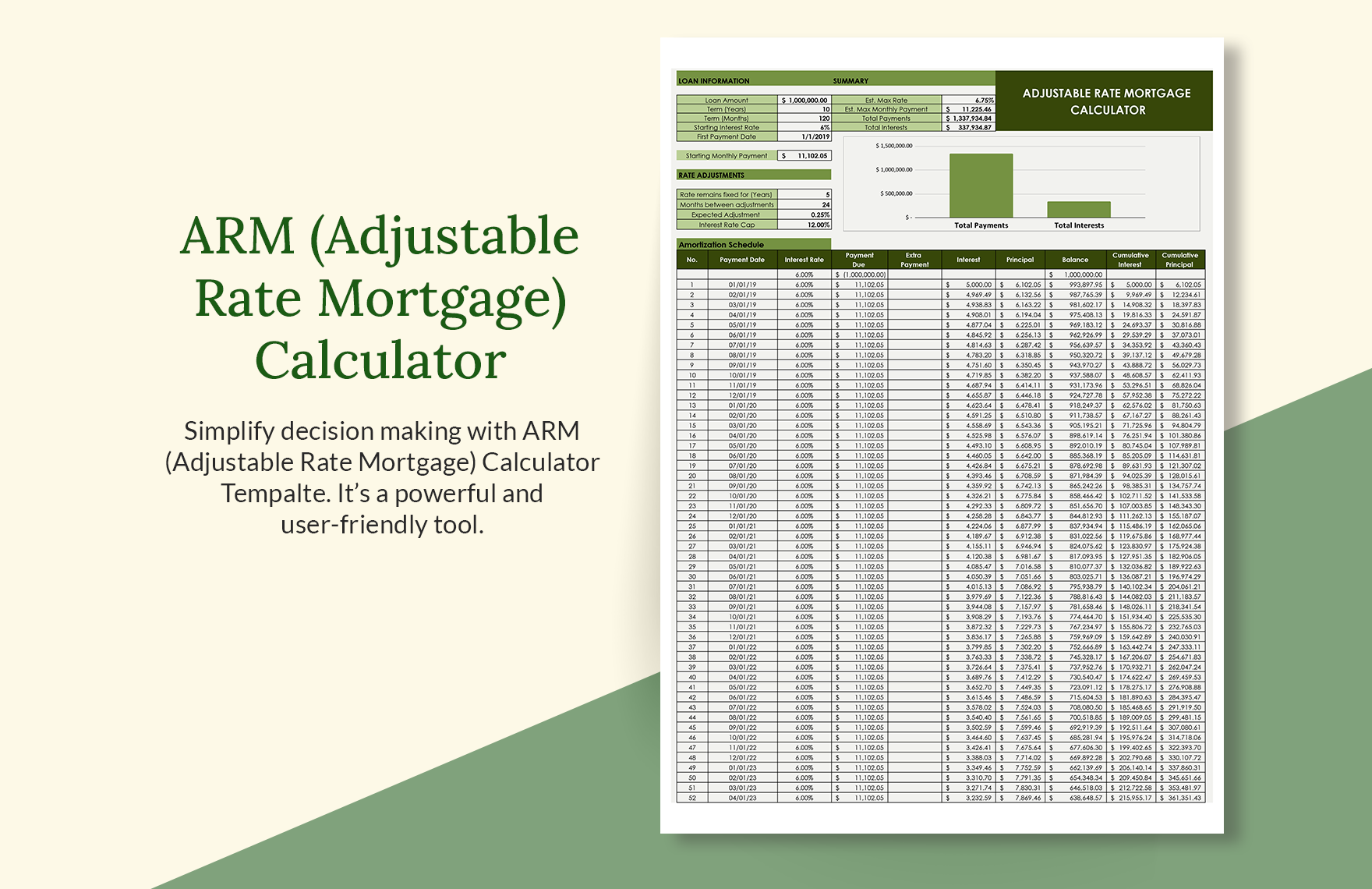

5 Year Mortgage Rates Calculator

Use this mortgage calculator to calculate estimated monthly mortgage payments and rate options. Loan amount Purchase price* Enter only numeric digits without. A mortgage calculator that estimates monthly home loan payment, including taxes and insurance Year FixedYear FixedAdjustable-Rate Mortgage. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. year fixed. years, whereas shorter loan terms generally lead to higher monthly payments. year fixed. year fixed. year fixed. 5-year ARM. Interest rate. Interest. calculator. CDs. CD guideBest CD ratesBest 3 month CD ratesBest 6 month CD ratesBest 1 year CD ratesBest 3 year CD ratesBest 5 year CD ratesCD calculator. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans. Today's mortgage rates in California are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new. Use this mortgage calculator to calculate estimated monthly mortgage payments and rate options. Loan amount Purchase price* Enter only numeric digits without. A mortgage calculator that estimates monthly home loan payment, including taxes and insurance Year FixedYear FixedAdjustable-Rate Mortgage. An online mortgage calculator can help you quickly and accurately predict your monthly mortgage payment with just a few pieces of information. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. year fixed. years, whereas shorter loan terms generally lead to higher monthly payments. year fixed. year fixed. year fixed. 5-year ARM. Interest rate. Interest. calculator. CDs. CD guideBest CD ratesBest 3 month CD ratesBest 6 month CD ratesBest 1 year CD ratesBest 3 year CD ratesBest 5 year CD ratesCD calculator. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans. Today's mortgage rates in California are % for a year fixed, % for a year fixed, and % for a 5-year adjustable-rate mortgage (ARM). Estimate your monthly payment with our free mortgage calculator & apply today! Adjust down payment, interest, insurance and more to budget for your new.

ARM interest rates and payments are subject to increase after the initial fixed-rate period (5 years for a 5y/6m ARM, 7 years for a 7y/6m ARM and 10 years for a. 5-year ARM, 7-year ARM. Interest rate. %. View today's rates. Property tax. $ A mortgage payment calculator helps you determine how much you will need to pay. 5/1 Adjustable-Rate Mortgage (ARM). A home loan designed to be paid over a The interest rates are usually comparable to a year mortgage, but ARMs. 5/1 Adjustable-Rate Mortgage (ARM). A home loan designed to be paid over a The interest rates are usually comparable to a year mortgage, but ARMs. Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. This calculator helps you to determine what your adjustable. Calculate monthly mortgage payments and current mortgage rates with Fifth Third Bank's mortgage payment calculator. See Term (years). i. Must be between 1 and. Mortgage Calculator · Interest Rate · Loan Term (Years)(Yrs) · Monthly Payment. Your loan program can affect your interest rate and total monthly payments. Choose from year fixed, year fixed, and 5-year ARM loan scenarios in the. Length of the mortgage (in years); Fixed or adjustable interest rate; Interest rate and annual percentage rate (APR); Closing costs. How can a mortgage. For example, say you have a $, loan balance with a 5% interest rate. For example, a year fixed-rate mortgage has lower payments, but you'll. Use this fixed-rate mortgage calculator to get an estimate. A fixed-rate loan offers a consistent rate and monthly mortgage payment over the life of the loan. Use this free tool to figure your monthly payments for a given loan amount. As a basic calculator it quickly figures the principal & interest payments on a. SmartAsset's mortgage calculator estimates your monthly mortgage payment, including your loan's mortgage, year fixed-rate mortgage or 5/1 ARM. The first. This mortgage payment calculator provides customized ARM loans often begin with a fixed-rate period that typically lasts from 5 to 10 years. 5-year mortgage calculator is an online personal finance assessment tool to calculate monthly repayment, total repayment and total interest cost on the. calculation – a monthly payment at a 5-year fixed interest rate of % amortized over 25 years. Don't worry, you can edit these later. Calculate. Mortgage. It will quickly estimate the monthly payment based on the home price (less downpayment), the loan term and the interest rate. There are also optional fields. The most common mortgage terms are 15 years and 30 years. Monthly payment: Monthly principal and interest payment (PI). Loan origination percent: The percent of. The Payment Calculator can determine the monthly payment amount or loan term for a fixed interest loan. a five-year loan, a three-year certificate of deposit, a one-year insurance policy, a year mortgage). Interest rate. The percentage of the principal.

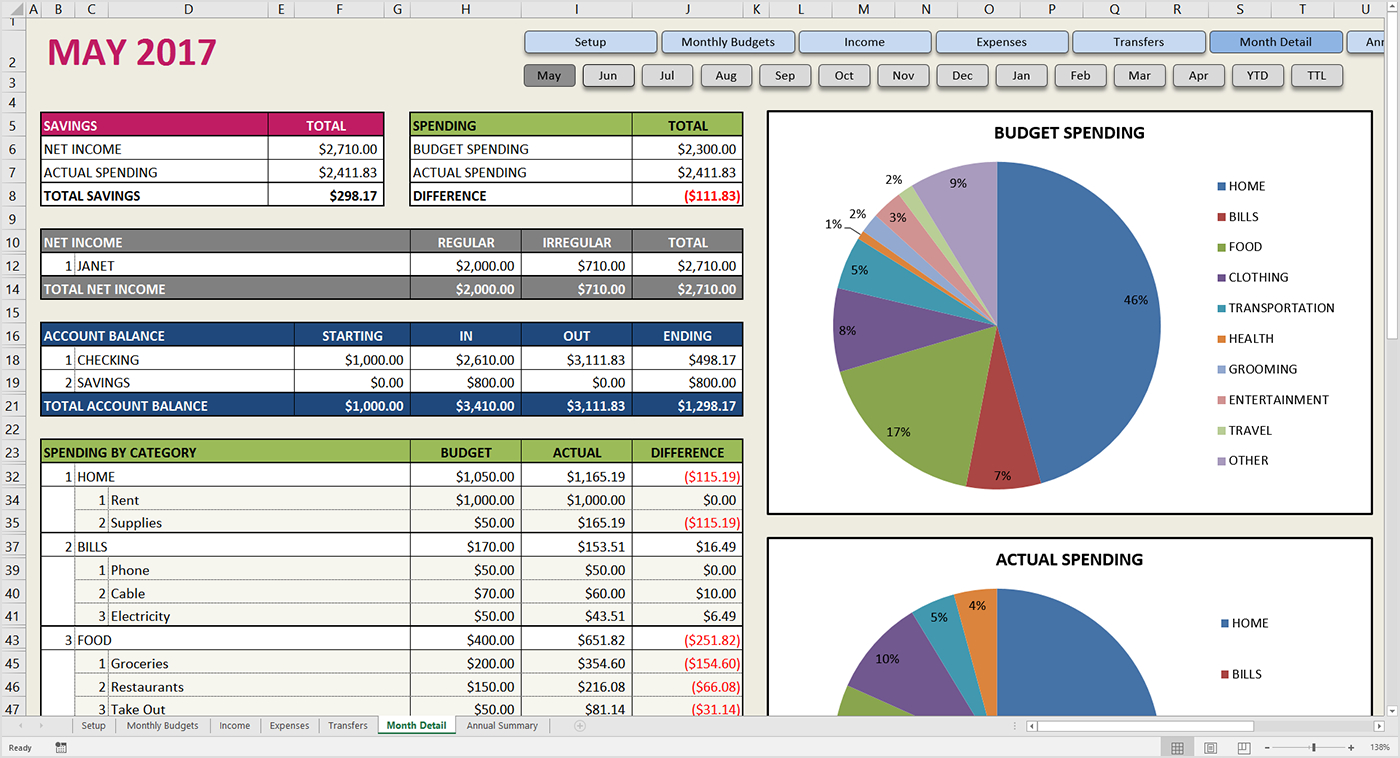

Budget Tracker Spreadsheet

Creating a monthly budget spreadsheet is a useful way to keep track of all these expenses and compare them with your income, so you can gain control over your. Our 70/20/10 Monthly Budget Planner Template will help you manage finances and allocate your income. Needs, wants, and savings are three main categories. PERSONAL MONTHLY BUDGET TEMPLATE. How to Use the Savvy Ladies Budget Spreadsheet · Input your income. Add in your disposable income at the top of the worksheet. · Fill the expenses section. Use these free personal budgeting templates to help you save time and money. Easily customize any of these budget templates in Microsoft Excel. Whether you need a personal budget, household budget, or department budget, track your income, expenses, and savings goals on this visual, customizable. Download free Excel Budget Templates for creating family, personal, business, and household budgets. Track Your Budget. A, B, C, D, E, F, G, H, I. 1. 2, BUDGET TRACKING WORKSHEET. 3, Enter your actual monthly income (Incoming Money), expenses (Outgoing Money). Manage your finances with Notion's Budgets templates. Track expenses, plan budgets, and set financial goals. Designed for individuals and families committed. Creating a monthly budget spreadsheet is a useful way to keep track of all these expenses and compare them with your income, so you can gain control over your. Our 70/20/10 Monthly Budget Planner Template will help you manage finances and allocate your income. Needs, wants, and savings are three main categories. PERSONAL MONTHLY BUDGET TEMPLATE. How to Use the Savvy Ladies Budget Spreadsheet · Input your income. Add in your disposable income at the top of the worksheet. · Fill the expenses section. Use these free personal budgeting templates to help you save time and money. Easily customize any of these budget templates in Microsoft Excel. Whether you need a personal budget, household budget, or department budget, track your income, expenses, and savings goals on this visual, customizable. Download free Excel Budget Templates for creating family, personal, business, and household budgets. Track Your Budget. A, B, C, D, E, F, G, H, I. 1. 2, BUDGET TRACKING WORKSHEET. 3, Enter your actual monthly income (Incoming Money), expenses (Outgoing Money). Manage your finances with Notion's Budgets templates. Track expenses, plan budgets, and set financial goals. Designed for individuals and families committed.

Budget Planner | Google Sheets | Monthly Budget Spreadsheet | Paycheck Budget | Expense Tracker | Weekly Budget | Financial Planner. If you have Microsoft Office, consider Microsoft Excel for your budgeting needs. Its suite of budgeting templates is designed to fit many different financial. You get a downloadable spreadsheet that's compatible with Google Sheets + Microsoft Excel complete with 5 separate tabs filled with formulas for tracking. Browse budget templates made for a range of uses, from regular monthly budgets to budgets focused on weddings, college, or saving for a home. Explore professionally designed budget templates you can customize and share easily from Canva. PERSONAL MONTHLY BUDGET TEMPLATE. Download our annual budget planner spreadsheet for personal and household use. Find out your monthly and yearly income and expenses. This budget template enables you to: work out where your money is going; create your own custom items; change the currency. Use our Excel spreadsheet. The spreadsheet you know with the power of a database and project management system. Gantt, Calendar, Kanban, Forms, and Automations. Get started free. If you're ready to move on from a static Excel budget template to a robust project management software, look no further than ProjectManager. It's easy to. Make a Budget - Worksheet. Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month's budget. Track your finances with Coplenty's Budget Spreadsheets for Google Sheets, ideal for individuals and families for both monthly and paycheck budgeting. Available as a Microsoft Excel or Google Sheets template, this budget worksheet has categories that are specific without getting too far into the weeds. There's. $ Stay organized and on top of your savings goals with this easy-to-use Monthly budget Spreadsheet. Additionally, Excel offers 'family budget planner' templates, ideal for managing household expenses, including children's education, extracurricular activities. Simply list all your income sources and their amounts in the Income table, and track your spending in the Expenses table. Easily find the total sum at the. Expense tracker by Sheetgo The Sheetgo Expense tracker template is ideal for anyone looking for a simple way to monitor expenses and automate financial. Free Online Budgeting Apps & Tools – Track Your Expenses to Make Money Management Easier. Budget calculator worksheet and spreadsheet that guides you and. It can help you track your income and expenses, identify areas where you might be able to save money and give you a more detailed view of your financial habits. It can help you track your income and expenses, identify areas where you might be able to save money and give you a more detailed view of your financial habits.

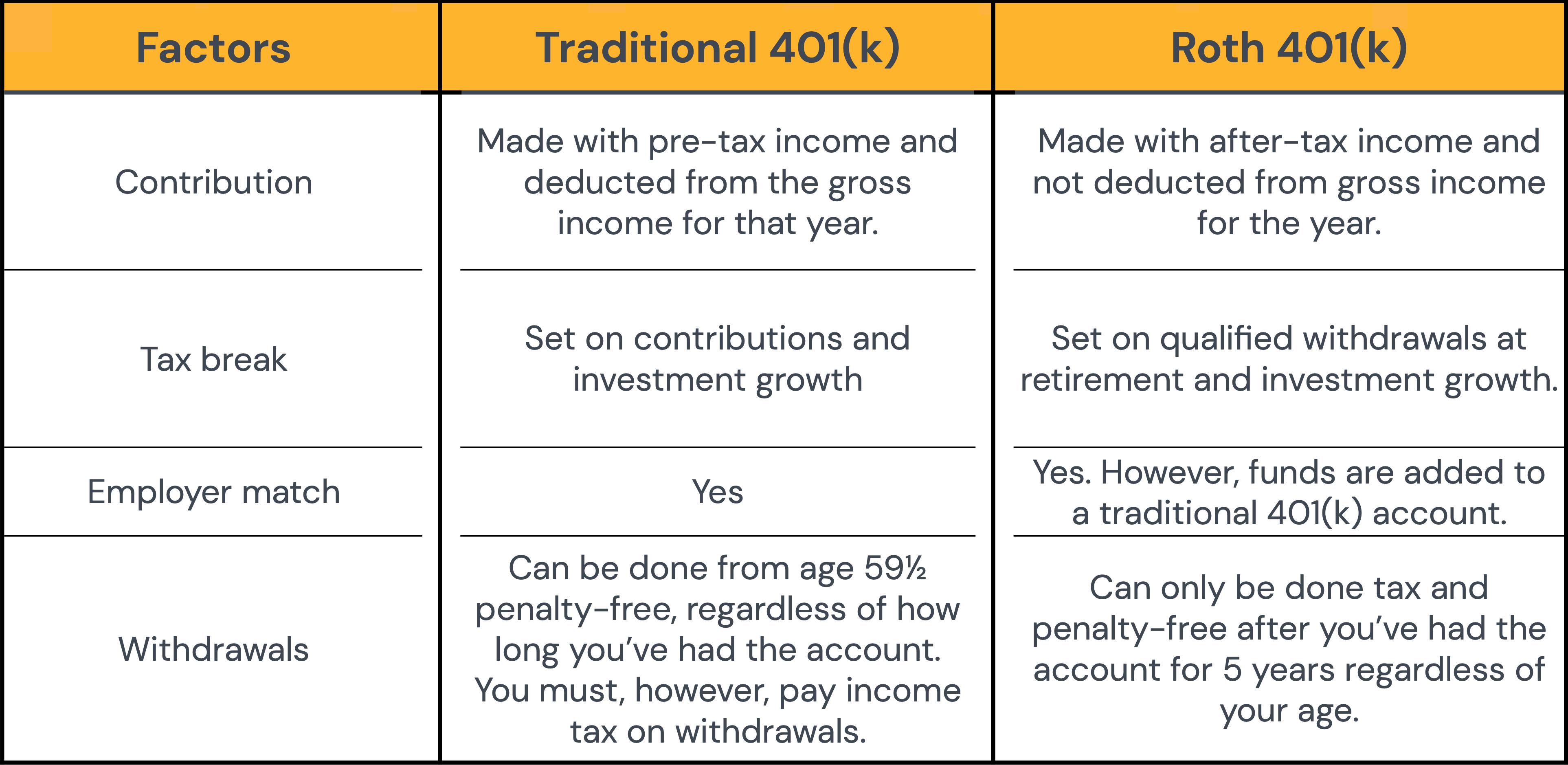

Difference Between A Roth And 401k

Traditional (k) contributions are made with pre-tax dollars, reducing your current taxable income, but you pay taxes when you withdraw funds. Differences between a Roth IRA & (k) · Investment choices · You can choose between taxable and tax-free withdrawals · Roth IRA funds are available for other. The key difference between a traditional and a Roth account is taxes. With a traditional account, your contributions are generally pre-tax ((k)) but tax. CalSavers is California's new retirement savings program designed to give Californians an easy way to save for retirement. Visit our website today to learn. For Roth (k)s, it's just the opposite. Your tax burden is higher now, but your retirement income is tax free1. Everything else—the investment options, the. The Roth (k) allows you to contribute to your (k) account on an after-tax basis - and pay no taxes on qualifying distributions when the money is withdrawn. Both Roth (k)s and Roth IRAs require after-tax contributions. This is a significant difference from the pre-tax contributions investors typically make to In simple terms: A Roth (k)—and its similar sibling, Roth (b)—is a retirement savings account with tax benefits. The main difference between a Roth and a. Any earnings then grow tax-free, and you pay no taxes when you start taking withdrawals in retirement Another difference is that if you withdraw money from a. Traditional (k) contributions are made with pre-tax dollars, reducing your current taxable income, but you pay taxes when you withdraw funds. Differences between a Roth IRA & (k) · Investment choices · You can choose between taxable and tax-free withdrawals · Roth IRA funds are available for other. The key difference between a traditional and a Roth account is taxes. With a traditional account, your contributions are generally pre-tax ((k)) but tax. CalSavers is California's new retirement savings program designed to give Californians an easy way to save for retirement. Visit our website today to learn. For Roth (k)s, it's just the opposite. Your tax burden is higher now, but your retirement income is tax free1. Everything else—the investment options, the. The Roth (k) allows you to contribute to your (k) account on an after-tax basis - and pay no taxes on qualifying distributions when the money is withdrawn. Both Roth (k)s and Roth IRAs require after-tax contributions. This is a significant difference from the pre-tax contributions investors typically make to In simple terms: A Roth (k)—and its similar sibling, Roth (b)—is a retirement savings account with tax benefits. The main difference between a Roth and a. Any earnings then grow tax-free, and you pay no taxes when you start taking withdrawals in retirement Another difference is that if you withdraw money from a.

Regular (k) and (b) retirement plans are funded with pre-tax dollars. Roth plan contributions are made with after-tax dollars. Understanding contribution. With a Roth (k), your contributions are made after taxes and the tax benefit comes later: your earnings may be withdrawn tax-free in retirement. Traditional. The investment options in a Roth (k) are limited to those that have been preselected by the administrator of the retirement plan. Roth IRAs don't have those. Roth (k) contributions allow you to contribute to your (k) account on an after-tax basis and pay no taxes on qualifying distributions when the money is. The main differences between the two types of Roth accounts come down to contribution limits, income limits, and RMD rules (for tax years and before). A Roth IRA is an individual retirement account; whereas a Roth (k) is part of and offered through an employer sponsored retirement plan. This minor confusion. May be rolled over directly to a Roth IRA with no tax payment. Roth vs. Traditional (k)s: A Quick Comparison. The table below presents a summary of some of. The good news is that if used correctly, once the funds are in your (k), you'll never pay taxes on them again. Your investments offer tax-free growth. Two of the most popular retirement accounts are the Roth IRA and the (k). The biggest difference between a Roth IRA and a (k) is that anyone with earned. Assuming you pay 24% in taxes, a traditional (k) will leave you with $2,,, to spend in retirement versus the $2,, tax-free in a Roth. This. The general answer is that there is no difference between a Roth IRA and Roth K. With most IRAs you can invest in almost anything. You could. Roth Comparison Chart, Comparison of Roth (k), Roth Roth IRA/Account Chart - Top Ten Differences Between A Roth IRA And A Designated Roth Account. With a Roth (k), your contributions are made after taxes and the tax benefit comes later: your earnings may be withdrawn tax-free in retirement. Traditional. Roth (k)s do have employee matching. The employee's contributions can be matched by the employer up to a certain percentage. This is essentially free money. Another key difference between the two retirement accounts is the income limits for contributions. With a Roth k, there are no income limits for. Your combined contributions to a Roth (k) and a traditional pretax (k) cannot exceed IRS limits. • Your contribution is based on your eligible. Roth vs. traditional: How do they compare? ; Contributions are made after-tax, so they don't reduce income taxes for the year in which you make them. The Roth (k) is a type of retirement savings plan. It was authorized by the United States Congress under the Internal Revenue Code, section A. Simply put, a Roth (k) is a retirement account offered by your employer that's funded with money from your paycheck that has already been taxed. The. What's the Difference Between a Roth (K) and a Roth IRA? · Higher contribution limits. Roth (k) plans allow for larger after-tax savings. · No income limits.

Last Day To Mail Taxes

Filing Extensions. Can't file by the deadline? Virginia allows an automatic 6-month extension to file your return (Nov. 1 for most filers). How To Determine When Taxes Are Due The income tax return due date is determined by the April 15th Tax Day. When this day falls on a weekend or holiday, it's. Official IRS Tax Dates · January 29, IRS Starts Processing Taxes · April 15, Filing Deadline for Taxes · October 15, Deadline for Extension. Payments: When Massachusetts income tax withheld is $ or more by the 7th, 15th, 22nd and last day of a month, pay over within 3 business days after that. The last day to file taxes for individual federal income tax returns is usually April 15 unless this falls on a Saturday, Sunday or official holiday. The returns and remittances are due on or before the 20th day of the month following the quarter during which the tax is accrued. (Example: Tax accrued in first. For tax year (filed in ), you needed to submit your tax extension request by Monday, April 15—the regular tax filing deadline—or face a penalty. If you. For example, if you are a U.S. expat and live in Canada, your general deadline for filing a U.S. income tax return with the Internal Revenue Service (IRS) is. But if you need a little longer, it's also the last day you can request an extension, which gives you until Oct. 15, to file your returns instead. If you. Filing Extensions. Can't file by the deadline? Virginia allows an automatic 6-month extension to file your return (Nov. 1 for most filers). How To Determine When Taxes Are Due The income tax return due date is determined by the April 15th Tax Day. When this day falls on a weekend or holiday, it's. Official IRS Tax Dates · January 29, IRS Starts Processing Taxes · April 15, Filing Deadline for Taxes · October 15, Deadline for Extension. Payments: When Massachusetts income tax withheld is $ or more by the 7th, 15th, 22nd and last day of a month, pay over within 3 business days after that. The last day to file taxes for individual federal income tax returns is usually April 15 unless this falls on a Saturday, Sunday or official holiday. The returns and remittances are due on or before the 20th day of the month following the quarter during which the tax is accrued. (Example: Tax accrued in first. For tax year (filed in ), you needed to submit your tax extension request by Monday, April 15—the regular tax filing deadline—or face a penalty. If you. For example, if you are a U.S. expat and live in Canada, your general deadline for filing a U.S. income tax return with the Internal Revenue Service (IRS) is. But if you need a little longer, it's also the last day you can request an extension, which gives you until Oct. 15, to file your returns instead. If you.

Are you looking for the latest tax news and updates? Go to: What's Trending Go to Mailing Addresses for Massachusetts Tax Forms for more information. The deadline to file individual income tax returns, without an extension, is April 15, Individuals. Most refunds are issued within 3 weeks from. What is the deadline for filing my Wisconsin return? Your return must be filed by April 15, , unless you have an extension of time to file. The due date for Individuals tax returns or requests for extensions are due by April 15, , (April 17, , if you live in Maine or Massachusetts). Your. Tax Day was Monday, April 15, , but some exceptions exist. Taxpayers who were granted extensions must file by Oct. 15, The Form tax return deadline: April 15, · Official IRS Tax Dates · State Payment Deadlines Vary · When does tax season start? · When are taxes due? · How. If you file by mail, your return must be postmarked by April 15, so get it in before the last collection time. Celeste E. Whittaker - Cherry Hill. Deadline to file federal individual income tax returns. · Deadline to file for a federal extension (see Form ) and pay any taxes owed to the IRS. What is the deadline for tax year individual income tax returns? If the U.S. Post Office postmarks your calendar year return by April 15, your. The returns with remittance of tax are due on or before the last day of January, April, July, and October for the proceeding three-month period. When the due. EXTENSIONS: If April 18th is your deadline and you cannot finish in time to mail your tax form by April 18th, you can mail a form to extend your deadline. This. Estimated tax · 1st quarter payment deadline: April 15, · 2nd quarter payment deadline: June 17, · 3rd quarter payment deadline: September 16, · 4th. Filing Deadlines ; Natural Gas Franchise Tax (R.S. - ), Last day of the 1st month following the taxable quarter, 1st day of 2nd month following. Are extensions available if I can't file my Wisconsin return by the due date? Your individual income tax return must be filed by April 15, Tax season officially begins the same day as Federal return processing (January 29, ) and tax Iowa tax returns are due April The filing deadline to submit tax returns or an extension to file is Monday, April 15, , for most taxpayers. All tax due is owed by April 15, Filing Deadlines ; 1, Individual, Last Day for Farmers and Fishermen to file Indiana Individual Tax Returns (in lieu of making estimated tax payment) ; 2 (March 1. Tax Day is the federal individual tax filing and payment deadline and is generally on April 15 or the following business day. · The IRS will extend tax deadlines. When to File and Pay · by April 15, , if you file on a calendar year basis (tax year ends Dec. 31, ); or · by the 15th day of the fourth month after the. Deadline to file federal individual income tax returns. · Deadline to file for a federal extension (see Form ) and pay any taxes owed to the IRS.

Vra Crypto

Adtech based on open-ledger principles | The 1st patented #adtech protocol on the blockchain - @Vera_Views | $VRA Join #Verasity - kaleco.ru VERA (VRA) Token Tracker on Etherscan shows the price of the Token $ Buy crypto and start earning up to 16% interest automatically. Buy Crypto. The price of Verasity (VRA) is $ today with a hour trading volume of $5,, This represents a % price increase in the. The current price of Verasity / Tether (VRA) is USDT — it has fallen −% in the past 24 hours. Try placing this info into the context by checking. USD = 1 VRA. Rate. You receive (estimate). Crypto Logo VRA. ethereum Network. Cryptocurrency Services Powered by Zero Hash. Buy Now. Powered by Transak. Verasity (VRA) is a cryptocurrency and operates on the Ethereum platform. Verasity has a current supply of 98,,, with 9,,, in circulation. Verasity USD price, real-time (live) charts, news and videos. Learn about VRA value, bitcoin cryptocurrency, crypto trading, and more VRA. $ %. Seamlessly check the live price chart and swap Verasity (VRA) for crypto, USD or other currency at the convenient exchange rate via an instant converter. Verasity USD Price Today - discover how much 1 VRA is worth in USD with converter, price chart, market cap, trade volume, historical data and more. Adtech based on open-ledger principles | The 1st patented #adtech protocol on the blockchain - @Vera_Views | $VRA Join #Verasity - kaleco.ru VERA (VRA) Token Tracker on Etherscan shows the price of the Token $ Buy crypto and start earning up to 16% interest automatically. Buy Crypto. The price of Verasity (VRA) is $ today with a hour trading volume of $5,, This represents a % price increase in the. The current price of Verasity / Tether (VRA) is USDT — it has fallen −% in the past 24 hours. Try placing this info into the context by checking. USD = 1 VRA. Rate. You receive (estimate). Crypto Logo VRA. ethereum Network. Cryptocurrency Services Powered by Zero Hash. Buy Now. Powered by Transak. Verasity (VRA) is a cryptocurrency and operates on the Ethereum platform. Verasity has a current supply of 98,,, with 9,,, in circulation. Verasity USD price, real-time (live) charts, news and videos. Learn about VRA value, bitcoin cryptocurrency, crypto trading, and more VRA. $ %. Seamlessly check the live price chart and swap Verasity (VRA) for crypto, USD or other currency at the convenient exchange rate via an instant converter. Verasity USD Price Today - discover how much 1 VRA is worth in USD with converter, price chart, market cap, trade volume, historical data and more.

Get Verasity price today, with VRA to USD charts updated in real-time. Explore latest VRA news, research, and fundraising We believe crypto is the technology. Buy VRA Verasity Coin Token Crypto Investors and Altcoin Fans T-Shirt: Shop top fashion brands T-Shirts at kaleco.ru ✓ FREE DELIVERY and Returns possible. Verasity (VRA) crypto is an innovative open-ledger ecosystem focused on combating advertising fraud and offering unrestricted access to infrastructure for. Whether you're a crypto newcomer or a crypto professional, kaleco.ru will be happy to offer you hassle-free VRA purchases. Purchase VRA with your credit. The current price is $ per VRA with a hour trading volume of $M. Currently, Verasity is valued at % below its all time high of $ This. CoinGecko Cryptocurrency Data API CoinGecko provides a fundamental analysis of the crypto market. In addition to tracking price, volume and market. - VRA real-time live price is - USD current market cap of $- USD crypto market, MEXC sets itself apart as a world-class cryptocurrency exchange. Verasity USD (VRA-USD). Follow. + (+%). As of August 24 at Crypto Heatmap · Biden Economy · Financial News. ABOUT. Data Disclaimer · Help. Verasity is a blockchain-based platform that improves spending efficiency of streaming video companies and the advertisers that sponsor their content. By using. USD = 1 VRA. Rate. You receive (estimate). Crypto Logo VRA. ethereum Network. Cryptocurrency Services Powered by Zero Hash. Buy Now. Powered by Transak. Browse the latest Verasity (VRA) cryptocurrency news, research, and analysis. Stay informed on Verasity prices within the cryptocurrency market. It is an ERC token developed on the Ethereum blockchain with a max supply of billion and a current circulating supply of billion. Verasity aims. Verasity (VRA) is an open-ledger ecosystem that aims to combat advertising fraud, provide infrastructure access to publishers and advertisers. A comprehensive list of exchanges where Verasity (VRA) We believe crypto is the technology of free people, free thinking, and free markets. Verasity (VRA) Price Range 7 Days A range in which the cryptocurrency price fluctuated within 7d. Market Cap Range 7 Days A range in which the. Stake and bake, do not worry about it atm, it's not like BTC is k, ETH 10k and VRA is still where it's at. The crypto market has not. Anchorage Digital is a regulated crypto platform that provides institutions with integrated financial services and infrastructure solutions VRA. Vertex. VRTX. Verasity Price Chart (VRA) The market capitalization of a cryptocurrency is its current price multiplied by its circulating supply (the total number of mined. "Not your keys, not your coins" is a widely recognized rule in the crypto community. If security is your top concern, you can withdraw your Verasity (VRA) to a. Verasity (VRA) is listed and actively traded on several leading global tier-1 cryptocurrency exchanges. This includes KuCoin, HTX, OKX, kaleco.ru, kaleco.ru

Best Time To Send E Newsletter

Tuesday, Wednesay, and Thursday are the two most popular days to send email newsletters, according to MailChimp. Tuesday, Wednesday, and. Morning (8 am – 10 am): Many studies suggest that sending emails in the morning can be effective. People often check their email first thing when they start. In general, weekdays are the best time to send a newsletter, and there's some evidence to suggest that sending your subscribers an email at mid-afternoon will. Interestingly, email opens are a bit more evenly distributed from around to However, it is clear that most emails are opened in the morning. In general, weekdays are the best time to send a newsletter, and there's some evidence to suggest that sending your subscribers an email at mid-afternoon will. We would recommend sending your email newsletter on Thursday. This is the day when all your subscribers start thinking about the weekend and are open to. The best time of day to send out emails, generally, is in the afternoon, especially around 3 pm. This is when the workday is winding down. The hours between noon and pm were the times of the day with the fewest emails. He suggests that you should send your newsletter at these times and have. In general, the consensus is that Tuesdays and Thursdays are the best days to send email newsletters, with Wednesday coming in a close third. This is confirmed. Tuesday, Wednesay, and Thursday are the two most popular days to send email newsletters, according to MailChimp. Tuesday, Wednesday, and. Morning (8 am – 10 am): Many studies suggest that sending emails in the morning can be effective. People often check their email first thing when they start. In general, weekdays are the best time to send a newsletter, and there's some evidence to suggest that sending your subscribers an email at mid-afternoon will. Interestingly, email opens are a bit more evenly distributed from around to However, it is clear that most emails are opened in the morning. In general, weekdays are the best time to send a newsletter, and there's some evidence to suggest that sending your subscribers an email at mid-afternoon will. We would recommend sending your email newsletter on Thursday. This is the day when all your subscribers start thinking about the weekend and are open to. The best time of day to send out emails, generally, is in the afternoon, especially around 3 pm. This is when the workday is winding down. The hours between noon and pm were the times of the day with the fewest emails. He suggests that you should send your newsletter at these times and have. In general, the consensus is that Tuesdays and Thursdays are the best days to send email newsletters, with Wednesday coming in a close third. This is confirmed.

A good time to send during a particular day is early in the morning—make sure the email reaches their inbox between 3 am and 7 am (for US audiences.) Another. In a B2C world, it turns out the early bird gets jack squat. When it comes to B2B email marketing, 53% of businesses have the most success sending emails before. Email Marketing emails: literally anytime, but between 11AM and PM is where we see the most conversions. For Cold Emails: stick to. The best time to send a newsletter is between and p.m. or between and a.m. when recipients start their day. If we dive deeper and find the. Data are essential to identify the right day and time to send your email campaigns. For this reason, today, we'll discover the perfect time to deliver your. Data are essential to identify the right day and time to send your email campaigns. For this reason, today, we'll discover the perfect time to deliver your. The best time to send a marketing email on Monday is 11 AM, with 6 PM holding the second place. So, when people have finished catching up with their weekend. Studies show that the best time to send an email newsletter is between 8 am and 9 am on Thursdays. While 8 am is pretty early in the day, users have reported a. The best time of the day that generates the most opens is between 10 AM and 12 PM (in the subscriber's time zone) and another peak is between PM. Emails sent in the late morning, especially between 9 AM and 12 PM, tend to have higher engagement. I tend to expect my emails to be top of the lisringsting in the morning, so my key point is to address them with “Good morning, “ as a salutation. According to Hubspot, the best time to send out an email is 9 a.m. to 12 p.m. If your recipients work a standard 9 a.m. to 5 p.m. office job. Tuesday: This is the best day to hit your recipient's inbox. Especially if you are the one sending email marketing campaigns or Cold Emails to. Tuesday and Thursday are the two most popular days to send email newsletters, as confirmed by MailChimp. Many of the “best send” windows — at organizations of all sizes — land on Sunday afternoons or in the earliest hours of a weekday morning. The simple answer is that it's typically best to send your emails around 10 am based on what most research suggests. Since people tend to check their emails. Newsletters: Newsletters are typically sent on a monthly or weekly frequency, which can be B2B or B2C. The right scheduling is important for achieving optimal. Surprisingly, late evenings (after PM) on Fridays or Mondays might also work depending on your audience. Email Type: Promotional emails. So when is it best to send an email? · Early morning. Hands down, this is No. · Lunch. A mid-day work break provides ample time for scrolling through email. The best time to send your newsletters is usually once or twice a week, during the middle of the week.